The Success Story of an Approved Retirement Fund (ARF)

In the realm of retirement planning, the journey of Mr. Flannery (name changed for confidential reasons) through his Approved Retirement Fund (ARF) offers an insightful case study into effective pension management and investment strategy. Here, we’ll dissect the elements that contributed to the success of Mr. Flannery’s ARF, providing valuable lessons for individuals aiming to optimise their retirement funds.

Background

Mr. Flannery, a senior manager in the Medical Sector, retired at the age of 68. Upon maturing his pension, he had a transfer value of €949,184 from his Defined Benefit Scheme. After taking a 25% lump sum, he invested the remaining €711,888 into a Zurich ARF in September 2016. This case study begins with his initial investment and tracks its growth over the years.

Investment Strategy

The strategic approach adopted by Mr. Flannery was to invest 100% of his ARF in a Risk Level 5 Portfolio. This portfolio has a medium to high risk profile, with a risk rating of 5-6 on a scale of 1-7 (7 being the highest risk). This portfolio’s allocation was predominantly in Equities (73%), supplemented by Alternatives (13%), Bonds (9%), and Property (5%). This diversified strategy was tailored to balance fund growth with risk management, aiming to maximise returns.

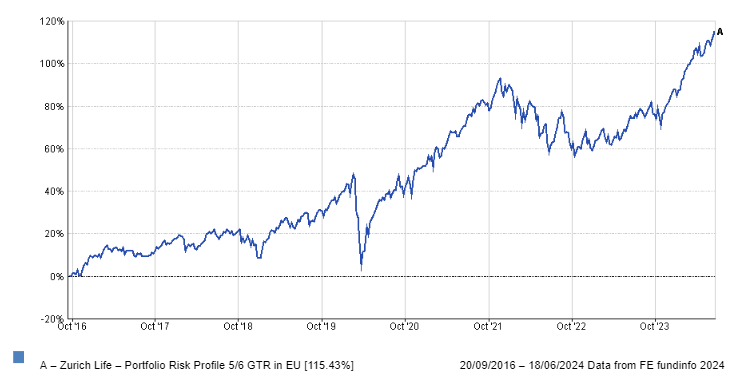

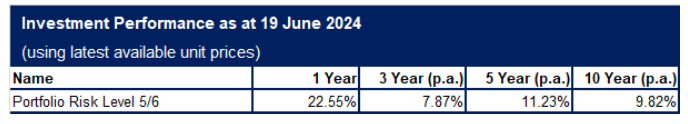

Performance Analysis

Over the years, Mr. Flannery’s ARF experienced substantial growth. Starting with an initial amount of €711,888, the fund value escalated to €1,010,579 by mid-2024.

Income and Withdrawals

From 2016 to 2023, Mr. Flannery enjoyed a total income of €306,524 from his ARF, demonstrating the fund’s capability to support his financial needs during retirement. This aspect is crucial as it highlights the dual utility of ARF’s in providing both a sustainable income stream and capital appreciation.

Lessons Learned

-

Strategic Diversification: Mr. Flannery’s choice to diversify his investments within the Portfolio has evidently paid off, emphasising the importance of a balanced/growth portfolio in achieving long-term financial goals.

-

Risk Management: Opting for a fund with a medium to high risk rating helped in navigating market volatility, while securing appreciable returns, showcasing the significance of aligning investment choices with one’s risk tolerance and retirement timeline.

-

Regular Review and Adjustments: The success of an ARF also depends on continuous monitoring and realignment of investment strategies based on market conditions and personal circumstances, underscoring the need for active financial management.

Conclusion

Mr. Flannery’s experience with his ARF illustrates a well-executed retirement strategy bolstered by thoughtful investment choices and proactive financial planning. His story serves as an inspiration and a guide for individuals planning their retirement, highlighting the importance of understanding risk, diversification, and the need for an adaptable approach to fund management.

This case study not only sheds light on the mechanics of an ARF but also reinforces the benefits of meticulous planning and expert guidance in navigating the complexities of retirement investments. For anyone looking to secure their financial future post-retirement, taking a leaf out of Mr. Flannery’s book could be the first step towards achieving similar financial independence and security.

Are you ready to take control of your retirement planning and achieve financial success similar to Mr. Flannery’s? Contact F J Hanly & Associates today to discover how we can help tailor a retirement strategy that fits your needs and goals. Don’t wait to secure your financial future. Reach out to us now and start your journey towards a successful and secure retirement.

Disclaimer: The value of your investment may go down as well as up. Past investment performance is not always an indicator of future performance.

get in touch

contact details

-

2nd Floor Riverpoint

Lower Mallow Street

Limerick

V94 WC6A - +353 (61) 310 533

- +353 (61) 310 464

- info@fjhanly.com