Why Investing in Gold is a Wise Choice in Modern Times

If you’re still getting to grips with the practice of investing, gold may sound like an archaic choice. After all, we are at a point in time that will be marked in the history books as the “birth of cryptocurrency,” so gold can feel like a step in the opposite direction.

But it isn’t, and that’s why assumptions are always best kept at a very far distance from financial planning! Savvy investors the world over treasure their gold right now. In fact, we actively promote diversifying a limited part of your investment portfolio with gold as a hedge. Why? Let’s get down to the details…

Why Invest in Gold? Gold is Finite

How much gold do you think there is in the world right now? Keep in mind that gold is finite. Therefore, gold doesn’t renew itself at a rate that will have any substantial bearing during your lifetime, or your children’s lifetime, or your grandchildren’s lifetime or your great-grandchildren’s lifetime… you get the idea. The answer is that the total amount of gold mined in human history is estimated to be the equivalent to a 21-metre cubic block.

Gold Performs Well Over Time

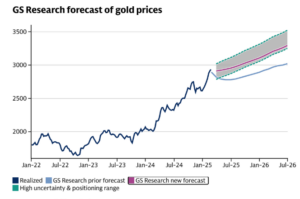

Historically, gold has proven to be a robust store of value. But its recent performance is even more compelling. Since January 2024, the price of gold has surged by over 40%, repeatedly breaking all-time records. This rally is being driven primarily by increased demand from central banks, which has surpassed expectations following heightened geopolitical and economic uncertainty.

Looking ahead, Goldman Sachs Research forecasts that gold prices will rise by a further 8%, potentially reaching $3,100 per troy ounce by the end of 2025. In more bullish scenarios, prices could rise as high as $3,300. This strong upward momentum positions gold as a strategic asset in the current climate.

The Investor’s Safe Haven

Think of gold as a backstop when things go badly askew, like a reversal in global growth causing deflation or when high inflation breaks out. Its purpose is to act as a hedge or insurance when value is being lost elsewhere in your assets. Therefore, if you’re looking for an investment that will protect your portfolio in times of crisis, gold is the way to go.

Ideal for Wealth Diversification

What is important to remember is that gold is money. It is a currency just like paper money. In fact, it is a liquid asset, which means it’s very easily converted into its cash equivalent. With all the clear advantages of investing in gold, it only makes sense to include it in your wealth diversification strategy. By spreading your wealth over a portfolio of carefully selected investments, you increase your chance of return and mitigate associated risks. We recommend that 10% of your liquid assets, including corporate reserves, should be in gold.

How to Invest in Gold: Gold Bars and Coins

For most investors today, the main way to gain exposure to gold is by tracking the performance of a Gold Exchange-Traded Fund (ETF) or a professionally managed fund. Popular options include the Zurich Gold ETF or the Aviva Physical Gold Fund. These investment vehicles allow individuals to benefit from the performance of gold without the need to physically buy, store, or insure the metal. By investing in a gold ETF or fund, you’re simply tracking the value of gold on the market, making it a convenient and cost-effective approach for those seeking to diversify their portfolios with minimal operational complexity.

Not Sure Whether Investing in Gold is Right for You?

Although we are advocates of wealth diversification with gold, investment suitability always depends on individual circumstances. For impartial, tailored financial advice, contact F J Hanly & Associates today. Our expert advisors will guide you in making confident and well-informed decisions that align with your long-term financial goals.

FAQs

What makes gold a good investment during economic uncertainty?

Gold acts as a hedge against inflation and deflation, making it a safe haven during economic downturns.

Is gold a liquid asset?

Yes, gold is a highly liquid asset, easily convertible into cash.

What percentage of my investment portfolio should be in gold?

It is recommended to allocate around 10% of your liquid assets to gold.

get in touch

contact details

-

2nd Floor Riverpoint

Lower Mallow Street

Limerick

V94 WC6A - +353 (61) 310 533

- +353 (61) 310 464

- info@fjhanly.com